Climate risk insurance is rapidly evolving from a niche product into a cornerstone of global financial resilience. As extreme weather events become more frequent and severe, the traditional boundaries of insurance are being tested. Floods, wildfires, hurricanes, and droughts are no longer rare anomalies—they are recurring threats that challenge the sustainability of communities, businesses, and entire economies. The future of climate risk insurance lies in its ability to adapt, innovate, and integrate with broader risk management strategies. It’s not just about compensating for losses; it’s about anticipating them, mitigating their impact, and building systems that can withstand environmental volatility.

Historically, insurance has relied on actuarial models built on past data. But climate change is rewriting the rules. Patterns that once held true are now shifting, making it harder to predict the frequency and intensity of natural disasters. This uncertainty demands a new approach—one that incorporates real-time data, predictive analytics, and interdisciplinary collaboration. Insurers are increasingly turning to satellite imagery, climate modeling, and artificial intelligence to assess risk more accurately. These tools allow for dynamic pricing, more granular underwriting, and faster response times. For example, a coastal property might be evaluated not just on its historical flood record but on projected sea-level rise, erosion trends, and infrastructure resilience. This level of precision helps insurers offer coverage that reflects actual exposure rather than generalized assumptions.

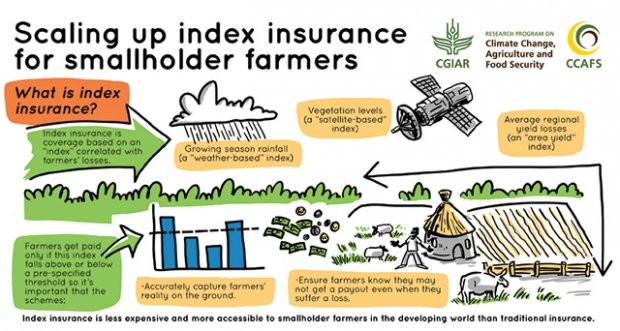

The future also calls for more inclusive and accessible climate risk insurance. Vulnerable populations, particularly in developing countries, often lack the financial means or institutional support to recover from climate-related disasters. Microinsurance and parametric insurance models are emerging as viable solutions. Parametric insurance, in particular, pays out based on predefined triggers—such as rainfall levels or wind speeds—rather than traditional claims processes. This allows for quicker disbursement of funds and reduces administrative burdens. In regions where agricultural livelihoods are at risk, these models can provide farmers with timely support to replant crops, repair damage, or invest in adaptive technologies. The challenge lies in scaling these solutions while maintaining affordability and trust.

Public-private partnerships will play a pivotal role in shaping the future landscape. Governments have a vested interest in promoting climate resilience, and insurers bring expertise in risk assessment and capital deployment. Together, they can create frameworks that encourage proactive adaptation. For instance, insurance incentives can be tied to climate-smart infrastructure investments, such as flood-resistant buildings or wildfire mitigation measures. Municipalities might receive premium discounts for implementing early warning systems or enforcing zoning regulations that reduce exposure. These collaborative efforts align financial incentives with environmental stewardship, fostering a culture of preparedness rather than reaction.

Another dimension of climate risk insurance is its integration with sustainability and ESG (Environmental, Social, and Governance) metrics. Investors and stakeholders are increasingly scrutinizing how companies manage climate-related risks. Insurance can serve as both a protective measure and a signaling tool. A business that secures comprehensive climate coverage demonstrates awareness and responsibility, potentially enhancing its reputation and access to capital. Insurers, in turn, are developing products that reward sustainable practices. A company that reduces its carbon footprint or invests in renewable energy may benefit from lower premiums or enhanced coverage options. This alignment between insurance and sustainability creates a feedback loop that encourages long-term thinking.

Technology will continue to be a driving force in this transformation. Blockchain, for example, offers potential for transparent and efficient claims processing, especially in parametric models. Mobile platforms can expand access to underserved communities, allowing individuals to purchase coverage, report events, and receive payouts with minimal friction. Data-sharing ecosystems can facilitate collaboration between insurers, governments, and NGOs, enabling coordinated responses to large-scale disasters. However, with these advancements come new risks—cybersecurity, data privacy, and algorithmic bias must be carefully managed to ensure that innovation does not outpace ethics.

Education and awareness are equally important. Climate risk insurance is only effective if people understand its value and how to use it. Outreach efforts must go beyond marketing to include community engagement, financial literacy, and transparent communication. When individuals and businesses grasp the connection between climate exposure and financial vulnerability, they are more likely to invest in protection. This cultural shift is essential for building resilience at scale. Insurance should not be seen as a luxury or a last resort—it should be embedded in planning, budgeting, and decision-making from the outset.

Ultimately, the future of climate risk insurance is about transformation. It’s about moving from reactive compensation to proactive resilience. It’s about designing products that reflect the complexity of climate change and the diversity of those affected by it. And it’s about forging partnerships that leverage the strengths of both public and private sectors. As the climate continues to change, so too must the tools we use to navigate its challenges. Climate risk insurance, when thoughtfully designed and widely adopted, has the potential to be one of the most powerful instruments in our collective effort to adapt, endure, and thrive.