Creating a zero-based budget is one of the most effective ways to take full control of your finances. Unlike traditional budgeting methods that may leave room for vague categories or unallocated funds, a zero-based budget requires you to assign every dollar of income a specific purpose. The goal is simple: your income minus your expenses should equal zero. That doesn’t mean you spend everything—it means you give every dollar a job, whether it’s going toward bills, savings, debt repayment, or discretionary spending. This approach forces clarity, intentionality, and accountability, making it a powerful tool for anyone looking to optimize their financial life.

The process begins with understanding your total monthly income. That includes your salary, freelance earnings, side hustle income, and any other sources of cash flow. It’s important to work with net income—the amount you actually take home after taxes and deductions—so you’re budgeting with real numbers. For example, if your gross salary is $4,000 but your take-home pay is $3,200, your budget should be built around the $3,200. This ensures that your plan is grounded in reality and avoids the trap of overestimating what you can afford.

Once you’ve established your income, the next step is to list all your expenses. This includes fixed costs like rent, utilities, insurance, and loan payments, as well as variable expenses such as groceries, transportation, and entertainment. The key is to be thorough and honest. If you tend to spend more on dining out than you’d like to admit, include it. If you have annual subscriptions or irregular expenses, break them down into monthly amounts so they’re accounted for. For instance, a $120 annual software subscription should be budgeted as $10 per month. This level of detail helps prevent surprises and ensures that your budget reflects your actual lifestyle.

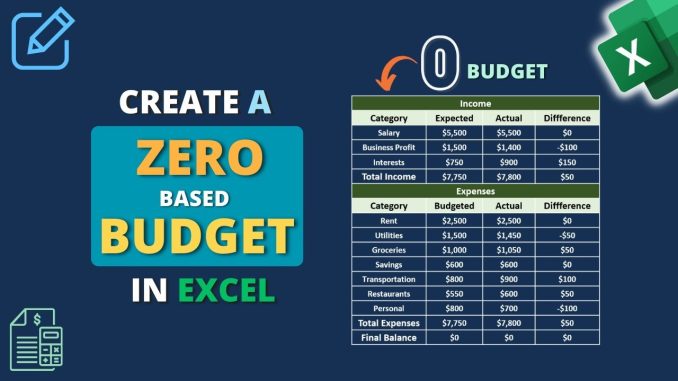

With your expenses listed, you begin the process of assigning your income to each category until every dollar is accounted for. This is where the zero-based concept comes into play. If you earn $3,200, you should allocate exactly $3,200 across all your spending and saving categories. That might mean $1,000 for rent, $300 for groceries, $200 for transportation, $100 for entertainment, $500 for debt repayment, $400 for savings, and so on. The idea is that nothing is left unassigned. Even if you’re putting money into savings or an emergency fund, it’s still considered an “expense” in this framework because it’s a deliberate use of your income.

One of the strengths of zero-based budgeting is its adaptability. It’s not a rigid system—it’s a responsive one. If your income changes or you have an unexpected expense, you can adjust your allocations accordingly. For example, if your car needs repairs and you have to spend $300 unexpectedly, you can reallocate funds from another category, such as entertainment or dining out, to cover the cost. This flexibility allows you to stay in control without abandoning your budget entirely. It’s a dynamic tool that evolves with your circumstances.

Zero-based budgeting also encourages mindfulness. When every dollar has a purpose, you’re less likely to spend impulsively or lose track of where your money is going. It creates a sense of discipline that can be surprisingly liberating. For instance, knowing that you’ve already set aside money for a weekend outing means you can enjoy it without guilt or second-guessing. Conversely, if you’ve budgeted tightly and a purchase doesn’t fit, you’re more likely to pause and reconsider. This kind of intentionality leads to smarter decisions and fewer regrets.

Technology can make zero-based budgeting easier to implement and maintain. Budgeting apps and spreadsheets allow you to track your allocations, monitor your spending, and adjust in real time. Many tools offer features like automatic categorization, alerts, and visual dashboards that make the process more intuitive. For example, seeing a pie chart of your spending can quickly reveal if one category is dominating your budget. These insights help you stay engaged and informed, turning budgeting from a chore into a habit.

It’s also worth noting that zero-based budgeting works well for both individuals and households. If you share finances with a partner or family, the method fosters transparency and collaboration. You can sit down together, review income and expenses, and make joint decisions about how to allocate funds. This process not only improves financial outcomes but also strengthens communication and trust. For example, agreeing on how much to spend on groceries or save for a vacation ensures that everyone is on the same page and reduces the likelihood of conflict.

Ultimately, creating a zero-based budget is about more than just numbers—it’s about intention. It’s about making conscious choices with your money and aligning your financial behavior with your goals. Whether you’re trying to pay off debt, build savings, or simply gain a clearer picture of your finances, this method provides a structured yet flexible framework to get there. It requires effort and attention, but the payoff is significant. You move from uncertainty to clarity, from reaction to strategy, and from financial stress to financial confidence. And in that shift, you begin to build a life that’s not just balanced—but empowered.